Samsung Electronics today reported financial results for the second quarter ended June 30, 2019. The Company posted KRW 56.13 trillion in consolidated quarterly revenue and KRW 6.6 trillion in quarterly operating profit.

The weakness and price declines in the memory chip market persisted as effects of inventory adjustments by major datacenter customers in the previous quarters continued, despite a limited recovery in demand.

The Display Panel Business reported improvement due to a one-off gain in mobile displays and stronger sales of rigid OLED panels, which offset losses from large displays.

The Mobile Business posted stronger shipments on new mass market models but was overall weighed down by slower sales of flagship models and increased marketing expenses. The Network Business posted solid results on the commercialization of 5G service in South Korea.

The Consumer Electronics Division was boosted by strong sales of new appliance products and improved profitability of refrigerators and washing machines, although profits from TVs fell slightly YoY due to intensifying competition.

Looking ahead to the second half, Samsung expects persistent uncertainties in the memory business, although demand is seen growing further on strong seasonality and adoption of higher-density products. For system semiconductors, higher demand in mobile APs, image sensors and display driver ICs (DDIs) is also expected to be seen.

For displays, new smartphone product launches are set to help mobile display earnings but overall sluggish demand in the broad smartphone market may limit upside potential.

As competition in the smartphone market is seen increasing in the second half, Samsung plans to enhance its product lineup and expand sales of new mass market models. The Network Business will prioritize building the foundation for its global 5G business expansion.

The Consumer Electronics Division expects a seasonal boost in TV sales and will focus on premium models, while offering new appliances such as Bespoke refrigerators and AirDressers.

The Company is facing challenges from uncertainties not only in business areas but also from changes in the global macroeconomic environment. Samsung will, however, continue to invest in enhancing business capabilities and future technologies, including 5G, system semiconductors, artificial intelligence and automotive components, for longer-term growth.

In the second quarter, Samsung Electronics’ capital expenditure stood at KRW 6.2 trillion, including KRW 5.2 trillion spent on semiconductors and KRW 0.5 trillion on displays. Total capital expenditure in the first half was KRW 10.7 trillion, including KRW 8.8 trillion for semiconductors and KRW 0.8 trillion for displays.

The main portion of the Company’s 2019 capex is earmarked for building infrastructure to address demand beyond 2019, and a larger percentage of this year’s investment will be made in the second half.

Note 1: Sales for each business include intersegment sales

Note 2: CE (Consumer Electronics), IM (IT & Mobile Communications), DS (Device Solutions), DP (Display Panel)

Note 3: Information on annual earnings is stated according to the business divisions as of 2019

Note 4: From Q1 2017, earnings from the Health & Medical Equipment Business (HME) are excluded from the CE Division

* This article was originally published here

The weakness and price declines in the memory chip market persisted as effects of inventory adjustments by major datacenter customers in the previous quarters continued, despite a limited recovery in demand.

The Display Panel Business reported improvement due to a one-off gain in mobile displays and stronger sales of rigid OLED panels, which offset losses from large displays.

The Mobile Business posted stronger shipments on new mass market models but was overall weighed down by slower sales of flagship models and increased marketing expenses. The Network Business posted solid results on the commercialization of 5G service in South Korea.

The Consumer Electronics Division was boosted by strong sales of new appliance products and improved profitability of refrigerators and washing machines, although profits from TVs fell slightly YoY due to intensifying competition.

Looking ahead to the second half, Samsung expects persistent uncertainties in the memory business, although demand is seen growing further on strong seasonality and adoption of higher-density products. For system semiconductors, higher demand in mobile APs, image sensors and display driver ICs (DDIs) is also expected to be seen.

For displays, new smartphone product launches are set to help mobile display earnings but overall sluggish demand in the broad smartphone market may limit upside potential.

As competition in the smartphone market is seen increasing in the second half, Samsung plans to enhance its product lineup and expand sales of new mass market models. The Network Business will prioritize building the foundation for its global 5G business expansion.

The Consumer Electronics Division expects a seasonal boost in TV sales and will focus on premium models, while offering new appliances such as Bespoke refrigerators and AirDressers.

The Company is facing challenges from uncertainties not only in business areas but also from changes in the global macroeconomic environment. Samsung will, however, continue to invest in enhancing business capabilities and future technologies, including 5G, system semiconductors, artificial intelligence and automotive components, for longer-term growth.

In the second quarter, Samsung Electronics’ capital expenditure stood at KRW 6.2 trillion, including KRW 5.2 trillion spent on semiconductors and KRW 0.5 trillion on displays. Total capital expenditure in the first half was KRW 10.7 trillion, including KRW 8.8 trillion for semiconductors and KRW 0.8 trillion for displays.

The main portion of the Company’s 2019 capex is earmarked for building infrastructure to address demand beyond 2019, and a larger percentage of this year’s investment will be made in the second half.

Semiconductor Sees 2H Demand Recovery Amid External Uncertainties

The Semiconductor Business posted consolidated revenue of KRW 16.09 trillion and operating profit of KRW 3.4 trillion for the quarter.

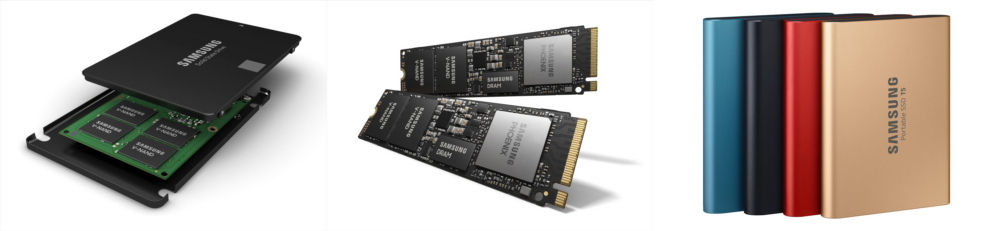

Despite weak market conditions, the Memory Business saw demand for NAND and DRAM increase as mobile and storage applications continued to adopt higher-density products and as datacenter customers resumed purchasing. In the second half, demand is expected to grow although the Company sees volatility in the overall industry due to increased external uncertainties.

For NAND, demand for high-density, high value-added datacenter and mobile storage is likely to continue to grow and the market is expected to gradually stabilize from the third quarter. In SSD, deployment of high-density, high-performance products for datacenters will expand, while demand for mobile applications is expected to increase with the release of high-end smartphones with storage of more than 128GB. The Company will focus on strengthening competitiveness in the premium market and plans to mass produce 6th generation V-NAND this year.

For DRAM, overall demand is expected to increase due to seasonal effects amid external uncertainties. Server demand is expected to increase gradually as customers adjust their inventory levels and resume purchasing, while PC demand is also likely to expand. Memory demand from mobile applications is expected to show a steady increase due to the launch of new models from major customers and the trend toward high-density products. The Company plans to actively address customer demand through a flexible product mix and maintain technical leadership with the ramping up of 1Y-nm products.

For the System LSI Business, earnings were solid as demand increased for multiple cameras and high-resolution, large-pixel image sensors. The Company also increased the supply of 5G chipset solutions and continued to develop a next-generation one-chip 5G System-on-Chip for future technology leadership. In the second half, demand for mobile AP, image sensor, and DDI products is expected to grow on stronger smartphone seasonality. Looking ahead, Samsung plans to increase the supply of high value-added products including 64MP image sensors and EUV 7-nm APs and also diversify product offerings by developing 3D/fingerprint-on-display sensors and chips for automotive and IoT applications.

For the Foundry Business, results were robust on the back of strong demand from a major customer’s 8/10-nm mobile AP and image sensor products. In addition, new orders from customers increased in the 10/14-nm process and applications diversified to include mobile, HPC, automotive and network products. In the second half, earnings growth is expected to continue due to the ongoing expansion of orders for AP, image sensors and DDI as well as increased demand for HPCs, including crypto currency mining chips. The Company plans to start mass production of EUV 6-nm process and aims to strengthen its competitiveness through tape-out of the EUV 5-nm process and by completing 4-nm process development.

Display Sees Further Improvement in 2H

The Display Panel Business reported KRW 7.62 trillion in consolidated revenue and KRW 0.75 trillion in operating profit for the quarter, returning to a profit from the previous three-month period thanks to a one-time gain and a gradual recovery in customer demand.

Mobile display earnings increased, led by higher shipments of OLED panels featuring new technologies such as fingerprint-on-display and hole display. Large display sales also saw a slight improvement from the previous quarter on demand for premium panels and reduced costs.

Looking ahead to the second half, Samsung expects a further recovery in mobile displays from stronger sales and higher production, as major customers are planning to launch new products. Demand for OLED screens is seen to grow steadily as the smartphone industry increasingly adopts slimmer displays to accommodate 5G-enabling components.

Samsung will continue to incorporate more value-added features into its panels and improve production efficiency, while closely monitoring and responding to global macroeconomic uncertainties and their potential negative impact on the market.

For large displays, despite growing demand for premium TV panels, continued capacity expansion in the overall LCD industry is likely to weigh on market conditions. Samsung will continue efforts to improve profitability by focusing on premium TV panels and expanding in other applications such as monitors and Public Information Display.

Mobile to Enhance Flagship Lineup and New Galaxy A series

The IT & Mobile Communications Division posted KRW 25.86 trillion in consolidated revenue and KRW 1.56 trillion in operating profit for the quarter.

While the overall market saw demand for smartphones decline due to the negative macroeconomic environment and seasonal weakness, Samsung’s smartphone shipments increased QoQ led by strong sales of the new Galaxy A Series, including the Galaxy A50 and A70. However, sales of flagship models fell QoQ on weak sales momentum for the Galaxy S10 and stagnant demand for premium products.

Increased costs associated with growing competition in the mid- to low- end segment and inventory adjustments of older models resulted in a drop in profit for the Mobile Business. On the other hand, earnings for the Networks Business improved thanks to the expansion of commercial 5G service in South Korea and LTE networks in overseas markets.

In the second half, the overall mobile market demand is expected to remain weak due to growing uncertainties over the global economy and trade. Samsung will continue to strengthen its flagship lineup and increase sales of new mass market models. The Company will promptly respond to the changing business environment, and step up efforts to secure profitability by enhancing efficiency across development, manufacturing and marketing operations.

In the third quarter, Samsung will focus on successful launches of new innovative products – the Galaxy Note 10 and Galaxy Fold. It will enhance the 5G smartphone lineup to take the lead in the new market and introduce more competitive A series models in the second half to extend the ongoing positive momentum in mass market smartphone sales.

The Network Business will continue to solidify its position in the global 5G market, leveraging its leadership in the 5G service commercialization in South Korea and the United States.

Consumer Electronics Boosted By Digital Appliances

The Consumer Electronics Division, comprised of the Visual Display and Digital Appliances businesses, recorded KRW 11.07 trillion in consolidated revenue and KRW 0.71 trillion in operating profit for the second quarter of 2019.

Earnings for the Visual Display business edged down both QoQ and YoY due to intensifying price competition in the market. However, Samsung’s product-mix improved in the second quarter via early launches of new models and the expansion of premium product sales such as QLED and super-large screen TVs.

Despite negatives such as unfavorable foreign exchange rates in some emerging markets and increasingly protective global trade practices, conditions in the TV market are expected to stay largely unchanged in the second half of 2019. Samsung plans to maximize end-year sales through close cooperation with retail partners and cementing the 8K leadership by positioning QLED 8K TVs as mainstream TVs.

For the Digital Appliances business, profits grew significantly YoY thanks to improvements in the profitability of key appliances like refrigerators and washing machines. Strong summer demand of air conditioners including Samsung’s Wind-Free Air Conditioner also contributed to robust sales.

Through the rest of the year, Samsung will focus on marketing new lifestyle products for consumers, such as Bespoke refrigerators and AirDressers. The Company will also continue to strengthen the B2B business which includes built-in appliances and system air conditioners.

※ Consolidated Sales and Operating Profit by Segment based on K-IFRS (2017~2019 2Q)

Note 1: Sales for each business include intersegment sales

Note 2: CE (Consumer Electronics), IM (IT & Mobile Communications), DS (Device Solutions), DP (Display Panel)

Note 3: Information on annual earnings is stated according to the business divisions as of 2019

Note 4: From Q1 2017, earnings from the Health & Medical Equipment Business (HME) are excluded from the CE Division

* This article was originally published here

![[Hands On] The Galaxy A80 is Empowering Live Content Samsung Galaxy A80](https://img.global.news.samsung.com/global/wp-content/uploads/2019/07/Hands-On-with-Galaxy-A80_main_2_F.jpg)

![[Hands On] The Galaxy A80 is Empowering Live Content Samsung Galaxy A80](https://img.global.news.samsung.com/global/wp-content/uploads/2019/08/Hands-On-with-Galaxy-A80_main_3.gif)

![[Hands On] The Galaxy A80 is Empowering Live Content Samsung Galaxy A80](https://img.global.news.samsung.com/global/wp-content/uploads/2019/07/Hands-On-with-Galaxy-A80_main_4.jpg)

![[Samsung At Your Service] ① Samsung Service Introduces Visual Support Feature for More Effective Diagnosis and Troubleshooting Support and troubleshooting](https://img.global.news.samsung.com/global/wp-content/uploads/2019/07/Visual-Support_main1.jpg)

![[Samsung At Your Service] ① Samsung Service Introduces Visual Support Feature for More Effective Diagnosis and Troubleshooting Support and troubleshouting](https://img.global.news.samsung.com/global/wp-content/uploads/2019/07/Visual-Support_main2.jpg)

![[Samsung At Your Service] ① Samsung Service Introduces Visual Support Feature for More Effective Diagnosis and Troubleshooting support and trouble shouting](https://img.global.news.samsung.com/global/wp-content/uploads/2019/07/Visual-Support_main3F.jpg)

![[Samsung At Your Service] ① Samsung Service Introduces Visual Support Feature for More Effective Diagnosis and Troubleshooting Support and trouble shouting](https://img.global.news.samsung.com/global/wp-content/uploads/2019/07/Visual-Support_main4F.jpg)

![[Interview] “AR Emoji Can Be a Visual AI Assistant” – Developers on the Galaxy S10 AR Emoji Samsung and Emoji Galaxy S10](https://img.global.news.samsung.com/global/wp-content/uploads/2019/07/AR-Emoji-Developer-Interview_main_1.jpg)

![[Interview] “AR Emoji Can Be a Visual AI Assistant” – Developers on the Galaxy S10 AR Emoji Samsung and Emoji, Galaxy S10](https://img.global.news.samsung.com/global/wp-content/uploads/2019/07/AR-Emoji-Developer-Interview_main_2.jpg)

![[Interview] “AR Emoji Can Be a Visual AI Assistant” – Developers on the Galaxy S10 AR Emoji Samsung and Emoji, Galaxy S10](https://img.global.news.samsung.com/global/wp-content/uploads/2019/07/AR-Emoji-Developer-Interview_main_3.gif)

![[Interview] “AR Emoji Can Be a Visual AI Assistant” – Developers on the Galaxy S10 AR Emoji Samsung and Emoji, Galaxy S10](https://img.global.news.samsung.com/global/wp-content/uploads/2019/07/AR-Emoji-Developer-Interview_main_4.gif)

![[Interview] “AR Emoji Can Be a Visual AI Assistant” – Developers on the Galaxy S10 AR Emoji Samsung Galaxy S10, Emoji](https://img.global.news.samsung.com/global/wp-content/uploads/2019/07/AR-Emoji-Developer-Interview_main_5.gif)

![[Interview] “AR Emoji Can Be a Visual AI Assistant” – Developers on the Galaxy S10 AR Emoji Samsung and Emoji, Galaxy S10](https://img.global.news.samsung.com/global/wp-content/uploads/2019/07/AR-Emoji-Developer-Interview_main_6.jpg)

![[Interview] “AR Emoji Can Be a Visual AI Assistant” – Developers on the Galaxy S10 AR Emoji Samsung and Emoji, Galaxy S10](https://img.global.news.samsung.com/global/wp-content/uploads/2019/07/AR-Emoji-Developer-Interview_main_7.jpg)